Focused Investment Strategies

In our focused investment strategies, we offer our clients several profitable investment solutions from as little as CHF 250,000. Whether it's a sophisticated trend-following model or active portfolio management – the right mandate for every investor.

-

Equity strategies with a clear focus

-

Income strategy only with bonds

SPM works with several top rated Swiss custodian banks. The custody account and securities accounts are managed exclusively with a limited administrative power of attorney and are always held in the name of the customer.

Swiss - Systematic

+ 5.23% performance since 1.1.2025

+ 47.83% performance since launch

+ 27.03% benchmark since launch

Investments are made exclusively in stocks that are represented in the Swiss Market Index (SMI). The position size of the individual stocks deviates from the respective market weighting in the SMI. Shares of banks are excluded.

The rule-based investment ratio varies between 80 and 100%.

Fixed Income

+ 1.95% performance since 1.1.2025

+16.84% performance since launch

– 0.77% benchmark since launch

Investments are made exclusively in CHF bonds.

The focus is on attractive, short-term and mortgage-backed bearer bonds (senior secured bonds). The offer is aimed at income-oriented, qualified investors (professional client in accordance with Art. 5 para. 1 FinSA). The investment ratio is adjusted to the supply ratios and varies between 0 and 100%.

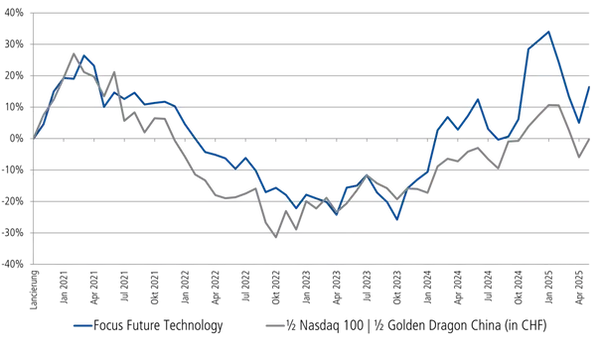

Future Technology

– 11.28% performance since 1.1.2025

+16.42% performance since launch

– 0.12% benchmark since launch

Investments are made exclusively in stocks that will play a major role in the future in the course of technological disruption. The investment universe is global, but will focus primarily on the US and Asia, the two centres of disruptive technologies.

The offer is primarily aimed at risk-averse investors who can shoulder an increased degree of volatility. In addition, there are currency risks due to the regional orientation of the investments. The investment ratio is dynamically adjusted to market conditions and varies between 0 and 100%.